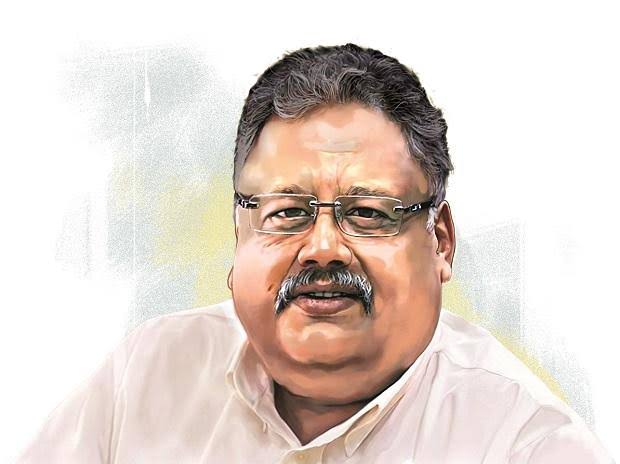

“You short India” Rakesh Jhunjhunwala calmly rebuked the television news anchor who was portraying a dismal economic scenario of India when Rakesh was explaining why was he bullish on India and India’s secular growth story. Well, that’s Rakesh Jhunjhunwala – straightforward, no-nonsense, and candid on your face. Take it or leave it. He didn’t tolerate agenda-driven narratives in public encounters. He didn’t bother to be politically correct either. In an interview, he said that he didn’t want Pappu to be his Prime Minister – showcasing his witty and unorthodox stance.

He was equally bold in his investment decisions. He stood firm on his research conviction and had the audacity to stay with those decisions. Titan was one investment idea that went on to become a multi-bagger and his best-known investment decision. He invested in Titan in 2002-03 when the company was not doing well. He remained invested in Titan forever and the investment become a folklore and a case study for long-term investment. Rakesh had many multi-bagger picks such as Lupin, Tata Motors, Crisil, and Escorts to name a few, that made him a legend. And he had some misses too such as NCC, Pantaloon Retail, Aurobindo Pharma, etc.,

Rakesh was born on 5th July 1960 in a Marwari family. He graduated in commerce from Sydenham College, the University of Bombay (now the University of Mumbai), and became a Chartered Accountant.

His investment journey started with only Rs.5,000, and he gradually built his wealth through astute stock market investments. Known for his long-term approach, Jhunjhunwala’s investment philosophy revolves around identifying promising companies with strong fundamentals and holding onto their shares for the long haul. He was also known for taking contrarian positions at times, which led to significant gains. In 2022 his investment portfolio was worth more than Rs.35,000 cr. This an achievement that drew comparisons to Warren Buffett, albeit a comparison he humbly refuted in an interview with Reuters.

Jhunjhunwala’s investment had a diverse sectoral distribution, including, watch & Jewelry, finance, pharmaceuticals, and information technology. He had a keen eye for identifying emerging trends and potential multi-baggers, which contributed to his success. He evolved over his business journey. His early picks were conventional Indian businesses or business groups. However, his investment in Nazara Technologies and Star Health demonstrated his foresight to identify emerging and future ideas and support them.

His vision to start a budget airline defied many traditional business wisdom. But today when Indian aviation is going through unprecedented growth and a demand for more alternatives makes absolute sense why did he start a new airline? His investment decision and engagement with companies had endowed him with the instinct to identify talent. He partnered with Aditya Ghosh, who had earlier a very successful stint with Indigo, India’s largest and most profitable airline.

Rakesh Jhunjhunwala’s Investment Philoshphy

It is interesting to examine Rakesh Jhunjhunwala’s investment philosophy and its key principles to understand his success.

- Long-Term Perspective: Jhunjhunwala was a strong believer in the power of long-term investing. He often held onto his investments for years, allowing them to compound over time and capture the value created by the companies he invests in.

- Fundamental Analysis: He placed great emphasis on understanding the fundamentals of the companies he invested in. This included analyzing financial statements, earnings growth, management quality, and competitive positioning. He looked for companies with strong business models and the potential for sustainable growth.

- Contrarian Approach: Jhunjhunwala was known for taking contrarian positions when he saw opportunities in the market. He was not afraid to go against the prevailing sentiment and invest in sectors or companies that others were avoiding, as long as he believed in their long-term potential.

- Quality Over Quantity: While he had a diversified portfolio, Rakesh focused on a relatively small number of carefully chosen stocks. He preferred quality over quantity and concentrated his investments on companies he believed had the potential to outperform.

- Risk Management: Despite his willingness to take calculated risks, Rakesh was disciplined in managing risk. He didn’t put all his eggs in one basket and ensured that his portfolio was well-balanced and diversified.

- Patience and Conviction: Rakesh demonstrated patience and conviction in his investments. He remained committed to his chosen stocks even during market fluctuations, believing in their long-term growth potential.

- Staying Informed: He kept himself well-informed about market trends, economic developments, and global events that could impact his investments. He believed that staying informed is essential for making informed investment decisions.

It’s important to note that while these principles reflect Jhunjhunwala’s general investment approach, every investor’s strategy evolves over time and is influenced by changing market conditions and personal experiences.

Rakesh was an investor with a long-term perspective however he was equally at ease with active trading if the opportunity arose. His ability to wear the hat of a trader and that of an investor at the same point in time was unique and rare.

Today 0n 14th August 2023, a year has passed since Rakesh Jhunjhunwala left for his heavenly abode, but his impact on Indian investment is unprecedented. He inspired generations of retail and institutional investors with his inimical style of stock picking, his keen investment theory, and his long-term commitment to those ideals.